FILL OUT THIS FORM FOR THE BULLETPROOF TRUST

Order Today And Get Instant Access To The Bulletproof Trust Package [$28,979.00

VALUE]

1

YOUR INFO

Fill Out The Form

2

Get Access

Click To Complete

We securely process payments with 256-bit security encryption

"PWA has helped me to secure my home, my income, my vehicles, my guns - everything!"

"With the money being in a Bulletproof Trust, all of my bank assets were unfrozen by Monday."

"My ex tried to take everything. But instead... the police had to escort her out... thanks to a Bulletproof Trust."

NOW YOU CAN INSTANTLY

PROTECT ANY ASSET

WHILE REDUCING YOUR TAX LIABILITY!

Taxes…. It’s a pain we all have to live with, right? WRONG! Contrary to popular belief, taxes are a voluntary system. Did you catch that? VOLUNTARY.

Even Steve Miller, former Director of the IRS, went on record at a Congressional hearing and stated that the tax system implemented by the IRS is not mandatory -- but a voluntary system (see source and source).

Deep down, we all know that rich people like Warren Buffet, Donald Trump, Bill Gates, Mark Zuckerberg don’t pay taxes… and even when they do, THEY PAY LESS THAN YOU (see source)!

Aren’t you tired of feeling hopeless and having 1/2 OF EVERYTHING YOU MAKE - STOLEN FROM YOU?

"Even my attorney said if it weren't for the private trust - everything could've been seized."

"If you're looking for a trust that's private and will protect you from litigation, you need this!"

"I know a few guys who handled their separations through the trust. Guess how much their wives got? Nothing."

He Who Does Not Assert His Rights... Has None!

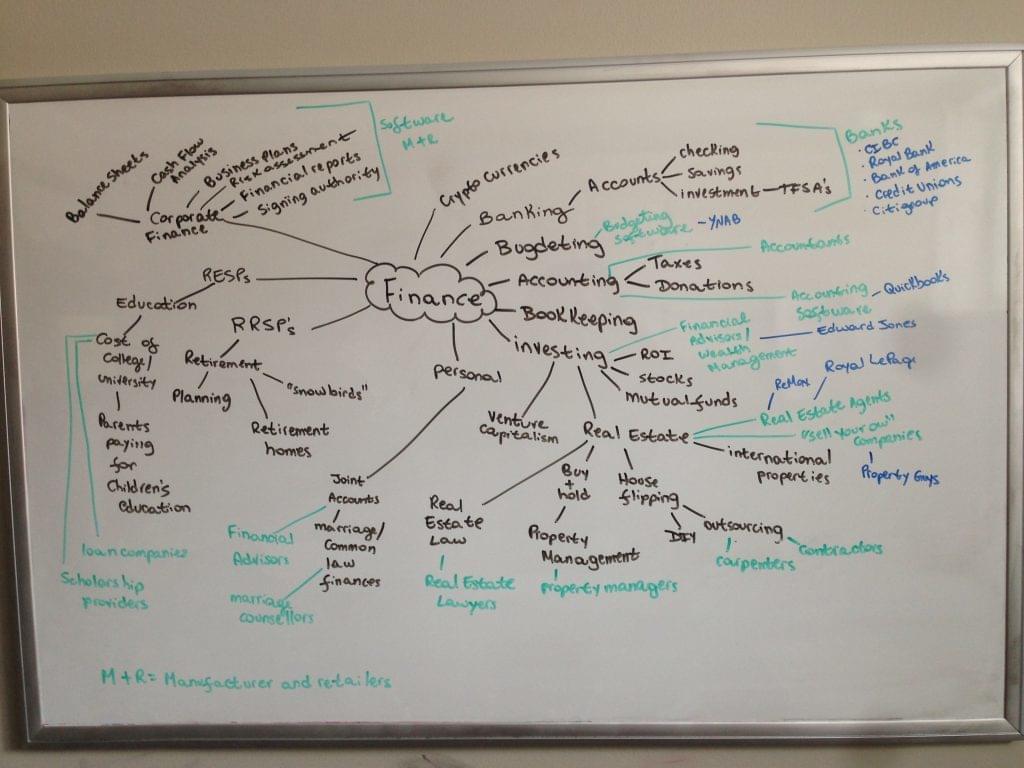

After one of our founding members, Carlton Weiss, began working for high-priced West Coast attorneys that pierced trusts of the rich and elite. In his research, we discovered these mega-corporations, Fortune 500 businesses and billionaires had something in common.

We began to reverse-engineer each step of their empires and when we did, we discovered they all had one common thread… A TRUST!

Once you learn how these trusts operate, break down how they are worded, what laws regulate them, how they can protect you and your assets; most importantly, you'll learn that this trust CANNOT be made by lawyers!

Call us crazy, but discovering this trust felt like an “Illuminati Secret” as very few public records exist regarding these types of trusts. In fact, there are only Supreme Court cases from the 1800's and ~20 rare antiquarian books on trust law that even discuss the matter!

Every time our trust paperwork was brought to a lawyer, the same thing would happen WITHOUT FAIL… they’d throw it out without another word or real explanation (except ONE constitutional lawyer who explained he legally couldn't create the trust on our behalf)!

Fast forward through the 50+ lawyers visited - when we decided to cut out the middle man (again) and have Carlton Albert Weiss - the legend of piercing trusts - create the paperwork for us!

What Carlton Weiss showed us changed everything. We took the new trust paperwork to four of America's largest multi-national banks (and each time)… minutes later we walked out of the bank with a Bulletproof Trust bank account.

"This [tax] year was different, we were tax non-obligated ... putting $15,000 back into our pockets!"

"Being a business owner is stressful enough... thanks PWA for showing me how to protect my business [and assets]."

"The trust saves you money but it always makes you money [by not owing taxes] and if look at it that way it pays for itself many times over."

What Did the Bulletproof Trust Do?

It allowed us to limit my tax liability just like the billionaires do! Wouldn’t you love to have full control over your finances and limit your tax liability like the ultra-rich do (see source)?

Trusts can work privately or like a business - I’ll show you how to do both (see source). A Bulletproof Trust offers more protection and less liability than popular business types like LLCs or corporations. This is the most powerful financial instrument known to man!

A Bulletproof Trust offers more protection and less liability than popular business types like LLCs or corporations. This is the most powerful financial instrument known to man!

"Last year, I paid almost $10K in taxes. I knew there had to be a better way. Turns out there is... it's called the Bulletproof Trust."

"Last month I almost lost everything in a single court case: my home, my car, my bank account. Thankfully, it was all protected in a trust!"

"I want to show how easy it was to open an Irrevocable [Bulletproof] Trust. It took me like half an hour and I had my trust set up."

Get Step-By-Step Training

Our instructors will virtually "hold your hand" as you fill in the documents and open your bank account.

Discover the incredible benefits of utilizing and working with the Bulletproof Trust to run your business and/or personal affairs with the utmost security and safety.

You won't find another offer like this!

"I opened up a trust bank account with the Bank of Montreal here in Canada... So this works internationally."

"The preverbal weight on my shoulders has been lifted. Fear of not being able to make payments or bills."

"I got the trust to keep my assets a little safer after my wife and I went thorugh a family court struggle... [so] we put everything in a trust."

THE 7 CORE MODULES

The Bulletproof Trust & All Documents [$4,997 Value]

The trust document (and contracts, security agreements, transfers of ownership, etc.) can't be drawn up by lawyers, If they could, it'd cost ~$20,000 in legal fees! Crazy, isn't it? But that's how powerful these documents are! But today, you can get access to our private vault with all our paperwork. Watch our video guide and we'll hold your hand as you create your own trust. Fill in the blanks with your information and you'll have your paperwork filled out and ready to take to the bank in no time!

Trustee Training Secrets [$2,497 Value]

Get training to become a Trustee to a Bulletproof Trust. What good is the world's greatest tool if you don't know how to use it? Protect all your assets: home, estates, vehicles, businesses, and more using our proven formula. Learn the pitfalls that cause liability to the public (and how to avoid them and win). Isn't it time you learned how to protect your assets like the elites do?

Trust Laws & Statutes Handbook [$2,997 Value]

Whether you realize it or not, everyone will want to see the source material at some point for their trust and what the Supreme Court has said about the absolute privacy and protection - that's why we have an entire library of antiquarian law books which would typically cost $150 to $300 per book - with a collection of 25+ books and growing as each member requests a new book (we allow 1 new purchase per member).

500+ Trust Documents For Operating [$5,000 Value]

Get templates for every type of action a trust could ever need: Hiring Employees or Independent Contractors, Creating Sub-Trusts or Sub-Corporations, Registering with the SoS, Security Agreements, Obligation of Debts, Secured Party Transactions, Liquidation, Banking, Business, Intellectual Property, Transfers & Exchanges, Sale/Purchase of Real Property Minutes, Securities, Agreements and so much more!

How to Create A Trust Web Structure [$2,997 Value]

Learn how to create multiple trusts and link each together in a web to limit risk. Typically one will have a trust to own the home you live in, another trust to own the business you work at, yet another to own the car you drive. Each trust will hold a limited amount of assets (money, gold, stocks, bonds, etc.). With this training, you'll know how to create unlimited trusts and diversify your risk to the point where any mistakes in "one part of your life" will NOT affect "the rest of your life."

Social Security Secrets To Remove SS Taxes [$4,997 Value]

Did you know that the tax system is voluntary in regards to reporting? There is reason for that and it's not what many "patriots" would have you believe. We'll break down how to "redeem your money" so that it does not qualify as income (via the use of private credit) and even divulge how to remove your SSN (only for those who hold ANY sort of religious belief in anything) from your W-2s so there are no withholding or SSI taxes. Believe it or not - there are only 4 times you are required to have a SSN: to obtain a driver's license, to register a vehicle, for tax matters, to obtain public assistance. Learn how to opt out forever!

Court Protection Secrets To Never Lose In Court [$4,997 Value]

This is a giant "next step" in your life... which means you are going to wonder - what if the "worst case scenario" happens to me? And the answer is simple - learn how you are already protected in court. Just because a lawsuit is entered against you personally or against the trust, does not mean there is a valid case! In fact, so long as there is no person or property that was injured (like a car accident or hurting a person), then our training shows you how to defeat every lawsuit that could occur.

FREQUENTLY ASKED QUESTIONS

How Will The Materials Be Delivered To Me?

Instantly! Upon checkout, you'll be redirected to the Member's Area login page. Enter your purchase email and set your password. Login and receive instant access to the materials.

Is There Additional Support Offered?

Yes, we offer 24/7/365 email support and free workshops.

Is There Anything That Will Cost Extra?

No, this process is completely free to do. All items you will need are shipped and sent to you.

Can I Put My Money Into The Trust And Not Pay Taxes?

All taxpayers must pay taxes owed! If you made income, even if one grants that asset into the trust, they still owe taxes. Consult with a Certified Public Accountant to know what taxes are owed after assets have been granted. Lawful money is the answer to the income tax.

Can I Modify My Bulletproof Trust After Notarization?

In short, 'Yes.' This is known as consent modification. There are a few different ways to go about this. We'll discuss this more inside, as there are multiple ways to change different parts of the Trust Indenture.

Why Am I Not Liable For Taxes With The Trust?

It depends on how one operates the trust. The trust is certainly capable of incurring tax liabilities by receiving a benefit from a public entity; however, if a trust does not incur income and does not divest dividends to shareholders by annuity, the ability to reduce tax liability to 0% is possible as we'll discuss inside the course.

Does A Company Filing A W-2 or 1099 Cause A Tax Liability For The Trust?

There is potential, but inside the Bulletproof Trust course we will show multiple examples of how this should not affect 99% of people living today. At the very least, there is no personal liability when contracting through the trust correctly - leaving future obligations for the trust to handle by itself.